You rely on data in business for a simple reason; it helps you make informed decisions. The more information you have, up to a point, the higher the chance you’ll make the right decision. You can apply that simple insight of more information equals smarter decision-making to marketing, customer service, product development, or any other sector of your business.

There are many ways to gather data for your business. Too many to cover comprehensively in a single article, that’s for sure!

This guide will focus on several survey research methods. You’ll discover the pros and cons of each approach and learn the best time to use them in your outreach strategy.

In this article

1. Online surveys

Online surveys are probably the most popular and widely used research method, certainly by small and medium-sized businesses. The main benefits of online surveys are threefold:

- Easy to run: there are lots of online survey platforms available. That gives you plenty of freedom to design an interesting survey and embed it however and to an extent, wherever you want.

- Easy to Analyze: the same software platforms will present the data nicely. That’s great for presenting your findings and analyzing the results.

- Cheap or almost free: you can run an online survey on a tiny budget. Assuming you have an email list or a site with lots of visitors, you should get respondents.

Lowering the cost and barrier to entry means many businesses manage online surveys independently. That’s a good thing. Below is an example of what an online survey may look like:

If you decide to run an online survey independently, take the time to research proper data collection methods. That’s a general thing to keep in mind for any survey research method on this list.

While online surveys are great, they do have their limitations. One of the biggest issues you’ll have is getting people to fill out your survey. Adding a survey to your site without context will result in a low number of respondents.

Ideally, you need to funnel people to your survey.

When asking people to fill in an online survey, you should always:

- Explain the benefits for the respondent

- Share how long it will take to complete

- Share a link to your survey

If you find it difficult to run your online survey independently, you can always turn to a consulting company to run it for you. Alternatively, there are sites where you can list your survey for free or pay the business for a certain number of respondents.

Overall, online interviews are a great way to get a sense of market or customer sentiment.

It’s important to note that acting and making changes in your processes and products based on data you collect from surveys is one of the things most companies running surveys forget to do. According to a recent study only 17% of companies act on customer insights they collect.

Don’t forget to actually make changes or draw conclusions based on the data you work so hard to collect.

2. In-person surveys

If you want a more personal approach, try the face-to-face survey. Face-to-face interviews are a great survey research method. They are a good way to gain deep insights from the respondent rather than general insights into market trends.

With a face-to-face survey, it’s easier to gain an overall impression of the respondent.

You can pick up things from the tone of voice and facial expressions. You’re also more likely to get longer answers, plus you get to ask follow-up questions. Finally, with each survey you conduct, you’ll gain insights into how to improve your approach for the next time.

As with each of the survey research methods on this list, there are limitations to face-to-face surveys. The most obvious problem is the sample size. The more face-to-face surveys you do, the more time it will take you and the more expensive the research will become.

Another issue you’ll run into is keeping track of responses and analyzing data. Whereas online surveys track everything for you automatically, you’ll need to do this manually with in-person surveys. If you bring a tablet with you to your interviews, you can use Google Sheets as a database for tracking qualitative and quantitative responses and then visualize that data using Sheets’ charts and graphs features.

If your sample is highly targeted, consider using face-to-face surveys. For instance, such surveys might be the better option if you want to determine your staff’s perception of your brand. But if you want to know your customers’ perception of your brand, online surveys may be your best bet since that’s a larger sample.

3. Focus groups

A focus group is a small group of people you get together to discuss a particular topic or a product. One group typically has five to ten people. The discussion is often facilitated by a moderator who gauges the group’s reaction and collects responses.

If you want to run a focus group, you should make sure your moderator will remain neutral throughout the discussions. They shouldn’t ask leading questions that may influence the answers of members of the group.

But how can you ensure the neutrality of your moderator if humans are inherently biased? You can’t. But you can at least make them act like they are during focus group discussions for the sake of the study. Brief them and make them understand your research goal. The person you assign to be a moderator should also have the following traits and characteristics:

- They can listen attentively with sensitivity.

- They are someone members of the group can relate to but at the same time, someone who exudes authority. For example, a male moderator is more appropriate if members of the group are males discussing sexual harassment in the workplace.

- They have adequate knowledge of the topic being discussed.

- They believe everyone has something to offer in the discussion.

Focus groups are one of the more expensive research methods. Companies typically pay $400 to $600 to each participant. Then there’s the amount you pay a trained moderator should you decide to hire one.

Focus groups can be hard to organize. You need to collect a group of people together and get them in one place. Though, video conferencing tools like Zoom or Whereby mean you can run a focus group remotely nowadays.

Focus groups are great for getting detailed impressions from a representative group. If you want to look at customer behavior, attitudes, and even at perceptions of processes, this is a great method for you.

You don’t need to be an offline company to use a focus group.

Fact of the day for you: Twitter used focus groups to come up with their platform. From the focus group discussions, they found people didn’t like Facebook’s cluttered news feed. They used that insight to come up with a more streamlined news feed for Twitter.

4. Panel sampling

Panel sampling involves randomly choosing a group of people to be part of a panel that takes part in a study over time. Panel samples allow researchers to study changes within the population, your customer base, or changes in individual people.

Companies, for instance, use them to generate qualitative data on customer experience as the product develops over time. If you want to track customer happiness over time, you can use panel sampling as well.

Panel sampling is a research method used more by sociologists than businesses. One of the major problems with panel sampling is attrition. It’s hard to keep the same people involved in your study over a period of months, or potentially longer.

Then there’s the fact that members of a panel tend to stick to the attitude or position they showed or expressed right from the start. So, they can end up misrepresenting the general population which they were supposed to represent in the first place. The general public’s attitudes and opinions, after all, are more likely to change over time because of external and internal factors.

5. Telephone surveys

Telephone interviews are a popular and widely used survey research method. Here are three good reasons why companies use telephone surveys:

- Targeting: you can run surveys targeting a particular demographic of a population

- Sample Size: it’s possible to gather a lot of data in a short time period

- Cost: it’s affordable. Assuming you have access to relevant contact information

Telephone surveys are often used to gauge customer satisfaction or get a sense of trends. They’re effective because they combine some of the automated benefits of online surveys with some of the personal benefits of in-person surveys.

If you see a poll by Pew, Gallup, or any other big polling firms, there’s a good chance that the data was gathered from telephone surveys. Telephone polling is used a lot all over the world around elections.

If you have an idea for an interesting study, it could be worth contacting a polling company to conduct some research for you. A good study with some interesting insights could be the hook you need for a good PR story.

Thanks to Voice over IP (VoIP) technology, it’s a lot cheaper to run telephone surveys than it used to be. All you need is a VoIP phone service with features like call recording, call queues, and call routing. With that said, if you don’t have the in-house manpower to run a phone survey yourself, you’ll probably want to look at outsourcing this to an agency with a VoIP system and a proven track record.

6. Mail-in survey

Mail-in surveys are mailed to respondents by post. They’re relatively inexpensive, and you can target a large geographical area. According to the National Public Research, a medium-scale mail survey can cost at least $5,000. That’s far less than the $10,000 to $15,000 you’ll need at the very least for a telephone survey, for example.

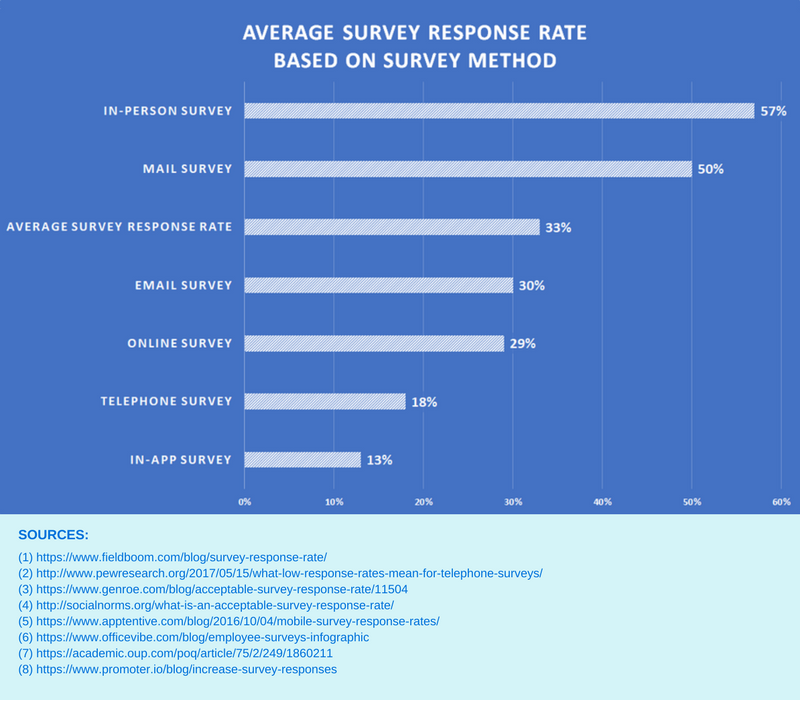

Response rates for mail-in surveys are also surprisingly high compared to other survey research methods. According to the latest benchmark report on surveys, mail-in surveys have a response rate of 50%. It just goes to show that you shouldn’t overlook traditional marketing channels.

The high response rates may have to do with the fact that respondents can answer the survey at their own pace. Because respondents more or less have all the time in the world, they can give comprehensive answers to the questions. They can be honest with their opinions as well since people are typically more comfortable expressing what they think and feel in writing.

With mail-in surveys, however, follow-up questions are not possible. That’s why your questionnaire design should be good from the get-go. If your questions were vague from the start, and you didn’t get the answers you needed, you’ll have just wasted your time and effort in administering the survey. You’ll have wasted the respondent’s time, too.

7. Kiosk surveys

The final and more niche option for gathering survey feedback is by using a kiosk survey. This is a survey on a computer screen located in physical locations such as offices, stores, lobbies, and hospitals. Kiosk survey research gathers instant feedback for a product or service.

Kiosk surveys are a good way to connect with local shoppers and residents. If you run a local business, it might be worth investing in this survey research method. It’s one way to get real-time feedback from your customers about their experience with your brand. You can then use the results of your survey to make the necessary adjustment to your strategies.

These types of surveys are becoming more and more popular at networking and business conferences. For example, a brand may set up a kiosk survey at their booth to gather reviews for their G2 or Capterra profiles.

It’s time to get some feedback

This article reviewed the seven types of survey research methods. The survey research methods range from online surveys to face-to-face interviews and mail-in surveys. Each of these research methods has its advantages and disadvantages.

Ultimately, the method you choose depends on your desired outcome and budget constraints.

Consider using a combination of survey methods for more accurate data, too. For instance, if you want to determine qualitative and quantitative data on customer satisfaction, the telephone interview will work well with an online survey. Just determine your goals and the resources you have at your disposal.

Pick that perfect combination that will generate the data you need to inform your business decisions. Your company will then be well on its way to success.