Your product doesn’t matter.

Don’t believe it?

Let’s talk about the giants to help you understand.

Sony and Microsoft sell gaming consoles with similar performance levels. But the PS5 has outsold the Series X at every turn. Why?

Because Sony offers a better customer experience—higher quality games, attractive platform exclusives and monthly free offerings for its subscribers (PS Plus members.)

In short, Sony knows it can’t compete with Microsoft on sheer product volume. So, it strategically leveraged its customer experience insights to draw in more users.

You can do the same in your field. The best bit? All it takes are well-designed surveys.

This article will tell you everything you need to know. Let’s dive right in!

In this article

Understanding the importance of customer experience insights

Why do businesses create customer surveys or gather feedback in general?

Is it to project a sense of community-driven product development? Maybe they wish to showcase how ‘attuned’ they are to their consumers’ preferences.

Wrong.

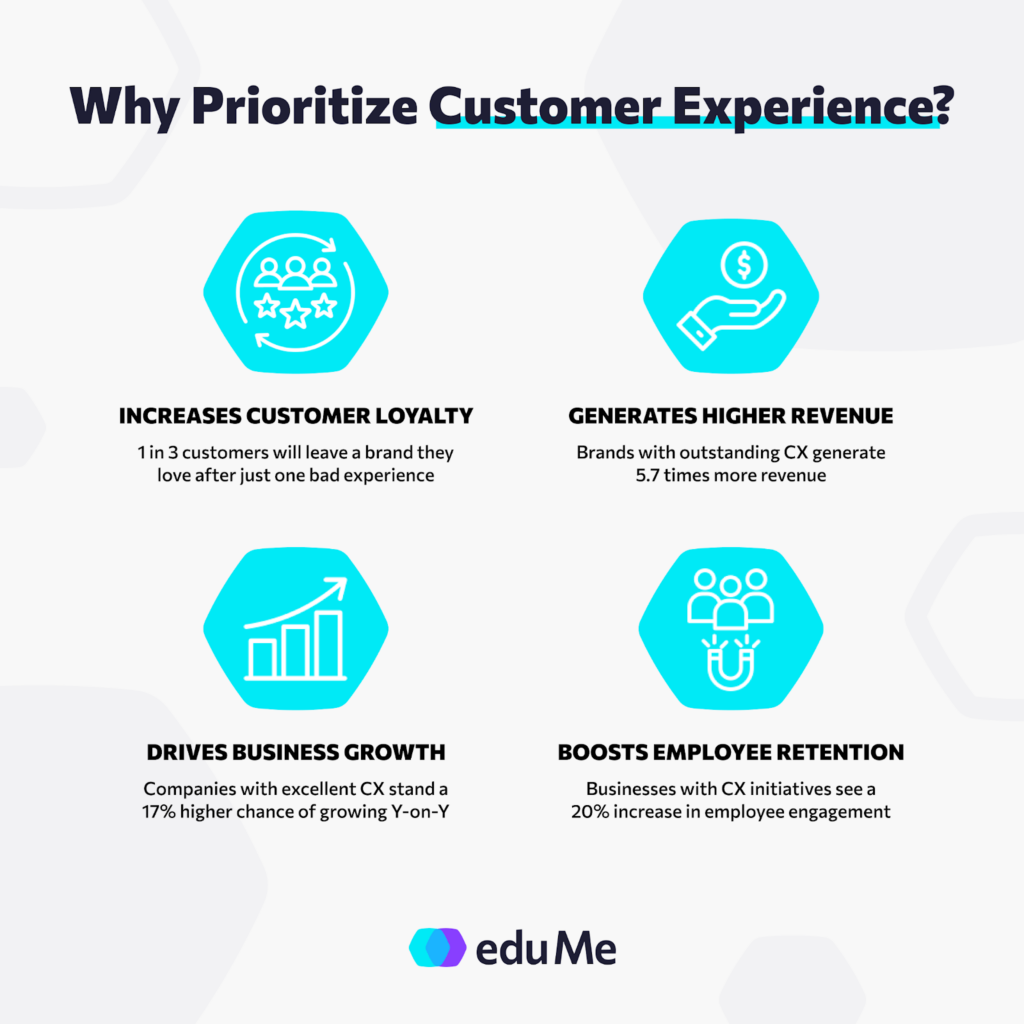

Research shows that 44.5% of businesses view ‘customer experience’ as a primary competitive differentiator. In short, they do it to gain an edge in the market.

And that’s where customer experience insights step in.

These are the actionable data points you gather by examining your audience’s feedback. They help you understand your market position, brand perception, potential issues in the buyer’s journey, and much more.

Now, when you build a CX strategy based on this information, it enables you to:

- Build dedicated buyer personas: Include demographic questions in your surveys to identify the preferences of specific consumer groups. Then, leverage that data to create detailed customer profiles to streamline your sales funnels.

- Drive product improvements: Deploy a customer satisfaction survey on niche features (or right after a launch) to highlight potential product issues. Use these insights to resolve existing bugs or refine aspects tied to ease of use.

- Break into new market segments: Compare demographic information across multiple audience segments to pinpoint similarities between them. Capitalize on this data to capture an entirely new audience.

Additionally, since consumer insights directly reflect your audience’s needs, they let you personalize your marketing content. Lean into it and use it as a guide to build impactful and compelling promotional campaigns.

6 survey types to collect valuable customer experience insights

Surveys are perhaps the most effective method for collecting customer experience insights. They let you pose targeted questions, receive unfiltered responses (at least in most cases), and are relatively easy to deploy.

Here are a few survey types that you can use to collect audience feedback:

1. Customer satisfaction (CSAT) surveys

Data from a 2023 study shows that 50% of customers switch to a competitor after just one bad experience. If it’s more than one instance, that number goes up to 80%.

That’s where CSAT studies can help. These surveys offer insight into immediate consumer satisfaction levels and are especially useful in tracking the success of specific events.

For example, wondering how happy users are with your software right after its launch? Use a CSAT questionnaire.

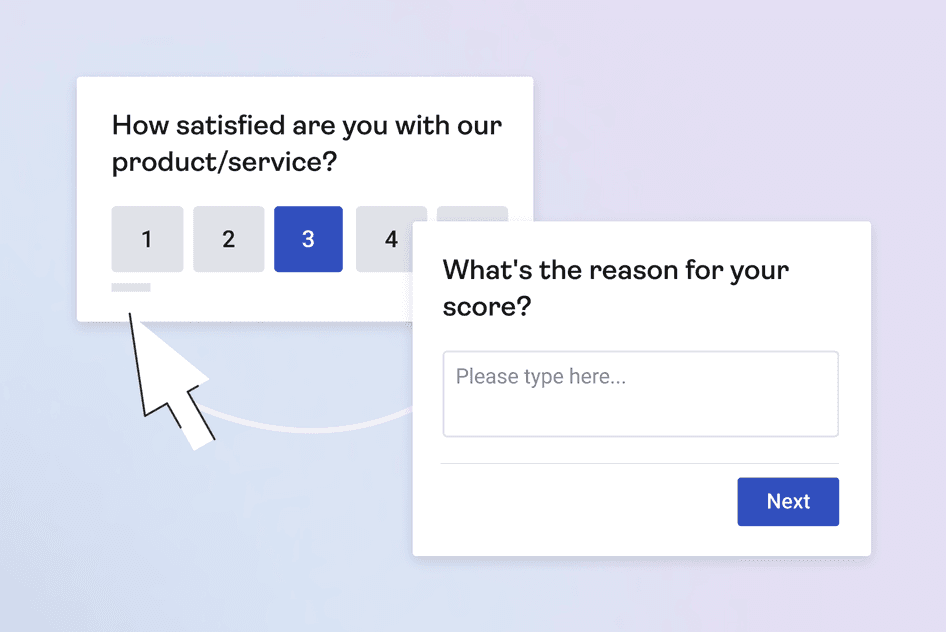

Regardless, when you design a CSAT survey, it’s best if you:

- Prioritize one query topic (Product Quality/Service Standards/Response Time)

- Follow up with an open-ended/MCQ question to let customers explain themselves

Here’s what a focused CSAT study looks like:

If you’re wondering about the instances where CSAT research is helpful, some good examples are:

- A couple of days after purchasing (earlier if it’s a digital product)

- A few hours into signing up for your platform

- When users are actively engaging with your app (use a simple, unintrusive pop-up)

- Immediately after a support call/chat or ticket resolution

- During post-checkout activity (also helps you leverage cross-selling opportunities)

As a rule, you’d want to conduct a CSAT survey when the experience is fresh in the customer’s mind.

2. Net promoter score (NPS) surveys

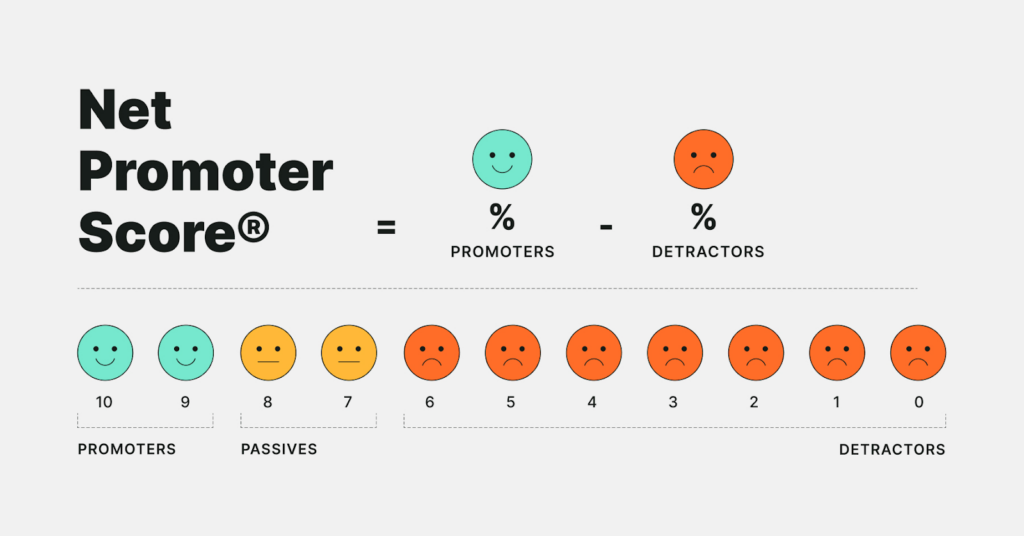

NPS surveys use a similar format to the CSAT variant. It has one primary query (Will you recommend X), followed by open-ended questions. The only difference is that an NPS study provides insight into a customer’s long-term relationship with your brand.

Generally, such surveys work best on a quarterly or bi-annual basis. But it’s also not a bad idea to push an NPS study before a particular business action.

For instance, you can request one before you create a marketing campaign plan. That’ll let you identify shifts in customer preferences and adjust your efforts accordingly.

Even so, some things are standard in all NPS questionnaires. This includes the following:

- Detractors (respondents unwilling to recommend) will assign you a score of 0-6

- Anything between 7-8 indicates passiveness (don’t factor in these responses)

- Promoters of your brand give you between 9-10

Once you’ve gathered the scores, use the formula below to calculate the result.

3. Customer effort score (CES) surveys

Studies show that customers who experience seamless channel transitions during support interactions are 80% more likely to stick to a brand. Put simply, the easier it is for buyers to become involved with specific actions, the better your chances are for retaining them.

A CES survey helps you gauge precisely that. Wondering if your sign-up process requires too much effort? Send a CES questionnaire to your users and let them rate it on a 0-10 scale.

In some cases, CES studies also help identify issues in other related areas.

For example, a low score for app simplicity/usage indicates confusing in-app walkthroughs. This is especially useful in B2B product marketing or the SaaS industry. After all, the easier it is to use a product/service, the higher the probability of someone buying it.

Now, there are three popular response formats for such surveys. They are:

- A Likert scale of 0-10 (0 being ‘very difficult’ & 10 being ‘very easy’)

- A straightforward questionnaire with the ‘agree/disagree’ option

- A visual/emoji rating system (😃/😐/🙁)

To gain measurable customer experience insights, it’s best to stick to the Likert scale. That makes it easy to analyze the results.

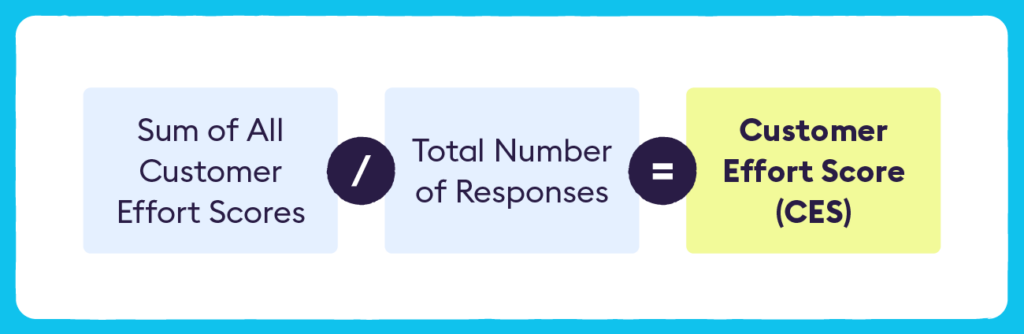

Speaking of which, here’s the formula to calculate your CES.

4. Goal completion rate (GCR) surveys

Similar to CES studies, GCR surveys track customer actions. The difference lies in the channels they monitor.

Where CES covers physical and digital customer interactions, GCR focuses on online channels. In short, it examines the reason why site/app visitors take (or, don’t take) certain actions on your platform.

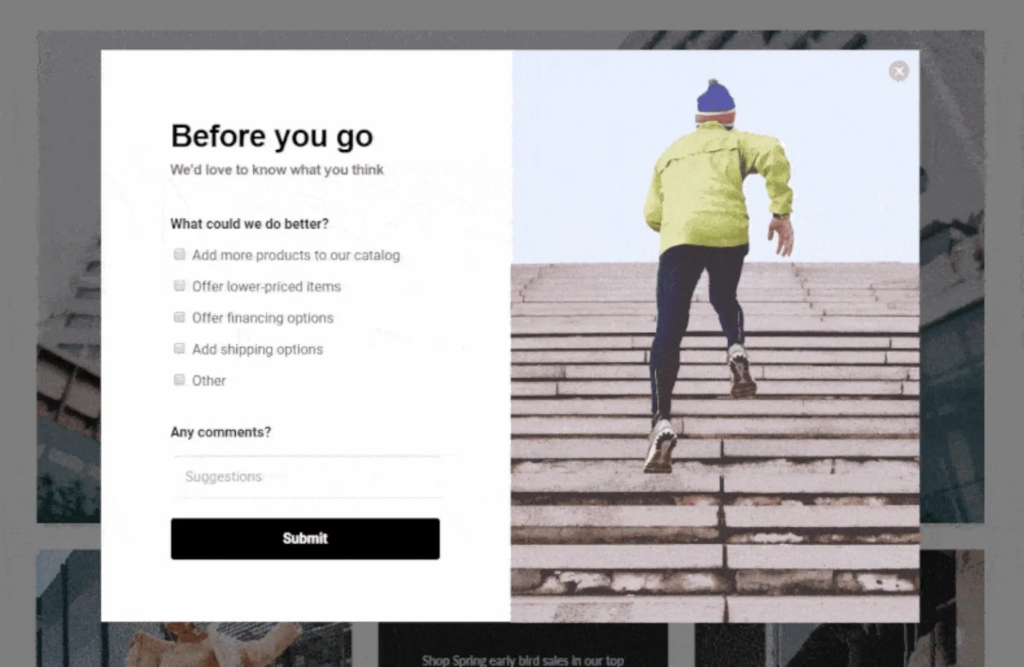

For instance, are people abandoning their carts midway through checkout? GCR surveys can tell you why. Pop-up tabs that show up the minute a site detects user inactivity are another great example.

That said, since customer goals are subjective, there’s no standardized format for designing a GCR questionnaire. Still, it’d be best if you:

- Pace your triggers (1-1:30 minutes for site inactivity)

- Offer multiple response options (MCQs + open text fields)

- Incorporate a user-initiated form (‘Can’t find what you’re looking for? Tell us why’)

- Avoid using it on the homepage or in the initial funnel stages

- Always ask for contact information (lets you reach out to failed prospects later)

It also helps to conduct CES and GCR surveys together. That gives you a comprehensive overview of all customer-related actions.

5. Custom surveys

Studies show that 85% of customers want to share feedback on products and services. And sometimes, pre-designed forms don’t capture that data effectively.

That’s where custom surveys come in.

These are modified questionnaires that shed light on hard-to-uncover customer experience insights. However, that doesn’t mean that they cover unrelated query topics. They are still hyper-focused but may target two or more CX elements.

These surveys also blend multiple response options/question formats. For example, they can include open-ended questions, comment or text fields, a rating system, etc.

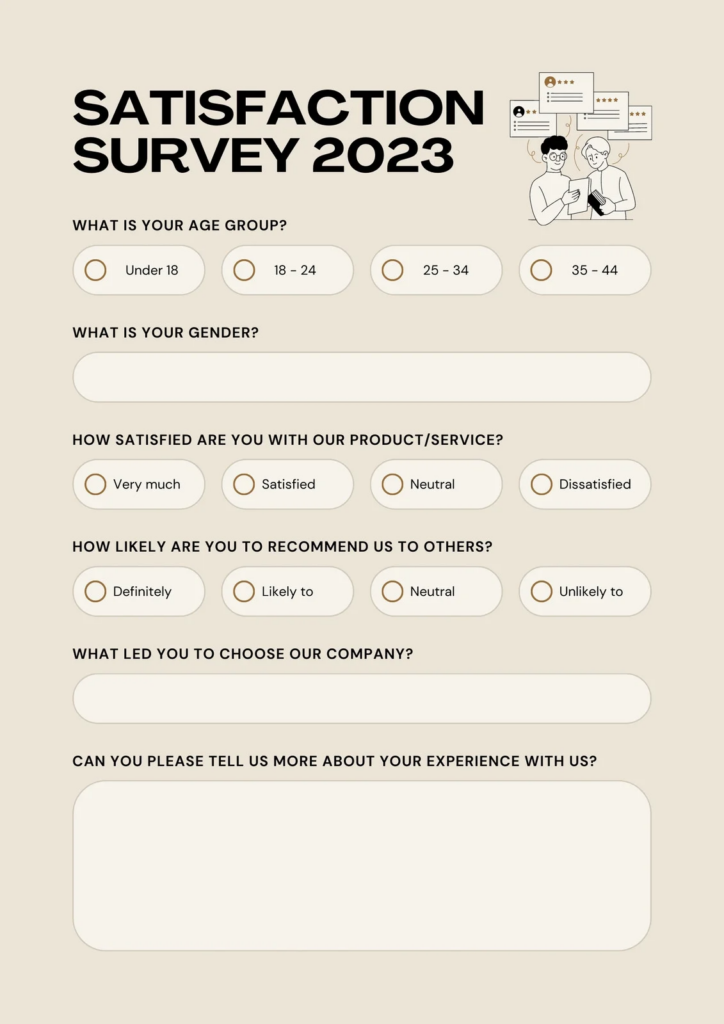

To understand this better, here’s a custom survey template that examines CSAT and NPS while factoring in audience demographics.

As for query topics, they can be anything—ask your audience their opinion on product features. You could even request feedback on ad perception and popularity to streamline customer acquisition costs. The choice is yours.

This flexibility is why custom surveys are so popular. Some other benefits they provide are:

- Offer Information on overlooked CX issues (especially with open-ended responses)

- Help collect qualitative insights from long-time customers

- Let you analyze multiple CX touchpoints and ditch a binary/restricted perspective

- Has higher response rates when tailored to consumer preferences

- Allow you to target niche CX aspects across specific audience segments

On a broader note, custom surveys are perhaps the most versatile option here. You can incorporate them into your CSAT research, NPS studies and CES forms.

6. Visual ratings

You already know what visual ratings are. You’ve seen them in customer support interactions, product reviews, and so on.

But if you need a refresher, here’s what the typical visual rating looks like:

As you’d have already guessed from that image, visual ratings are:

- Intuitive and easy to execute

- Often the fastest way to collect consumer feedback

- Easily understood by your buyers (helps avoid low completion rates)

- Universally recognized and, therefore, offer significantly high response rates

Regardless, its benefits can also be a detractor in some cases. For one, a visual survey will never offer detailed customer insights. They tell you whether a problem exists and not the actual reason behind it.

To get around this, consider using them only with AI-assisted customer service channels. This can include chatbots, self-service assistants, or automated support responses. If nothing else, that’ll at least help you review potential problems in your automation strategy.

Best practices for designing & deploying CX surveys

You know the best-performing survey types for collecting customer experience insights. However, that won’t matter if you don’t follow a few established guidelines.

Below, we’ve listed three guiding principles that you must stick to when designing and deploying your CX surveys:

Understand survey ‘categories’

All the survey types fall under four distinct categories. They are:

- Transactional: Versatile questionnaires that can be deployed at periodic intervals or after a particular event (CSAT, NPS, product feedback)

- Relational: Offer in-depth information on brand-customer relationships over time (NPS & custom surveys)

- Customer journey: Provide insight into elements related to streamlining the buyer’s journey (CES, GCR surveys)

- Post-interaction/conversion: Quick, easy-to-execute studies that collect instant data (but superficial data) on particular CX aspects (CSAT ratings, visual surveys).

Understanding these categories will determine who you request information from and when to deploy a survey.

For instance, relational surveys can be focus-intensive. So, they go to long-time clients since they are the most likely to engage with your feedback process. Similarly, studies tied to the customer journey work best when prospects approach the tail-end of the sales funnel.

Design your surveys to be short and simple

Surveys with too many query topics will never yield valuable customer experience insights. They also directly lower completion rates.

So, it’s best to keep things focused and simple. A few helpful tips here would be to:

- Keep questions limited to 10 or less

- Don’t use industry jargon or complex terms (speak your respondent’s language)

- Limit open-ended questions to 2-3 since they require more effort to answer

- Use 0-10 scales and emoticon ratings whenever possible

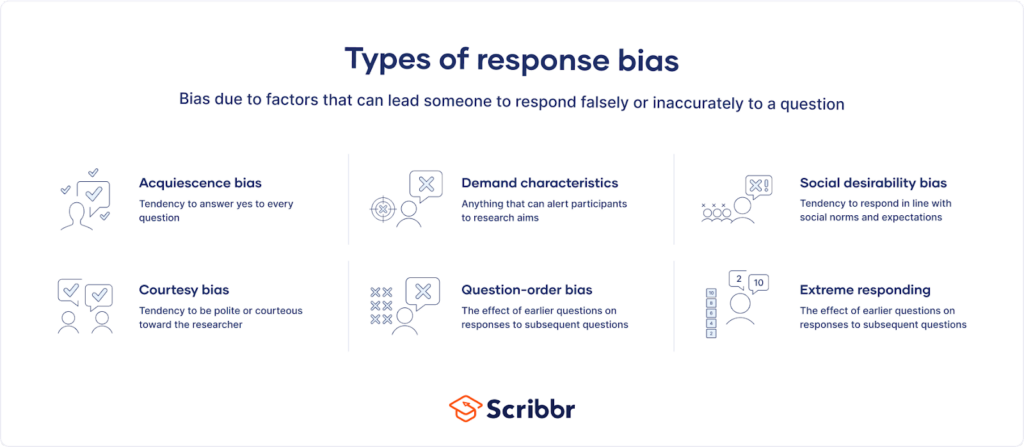

- Avoid leading questions to prevent biased or skewed responses

You can also rely on customer-preferred channels to gather customer insights. For example, social media analytics tools can tell you which platforms offer the highest engagement. Merely publish your survey there to increase response volume.

Avoid inducing feedback fatigue

Using surveys too often can turn customers off. After all, nobody wants to spend their time answering questions.

To get around this, you could:

- Incorporate easy-to-understand formats (visual ratings, scaling system, etc.)

- Pace your requests (use quarterly surveys for intensive questionnaires)

- Gamify survey forms with challenges, badges, redeemable in-app points, etc.

- Offer small monetary benefits (discounts, coupons, etc.) to incentivize completion

- Remove friction points (optimize for mobile, include a progress bar, etc.)

Ultimately, it’s all about relaying to your customers how valuable their feedback is. Make them see that the more they say, the better their experience gets.

Kickstart your CX strategy with actionable customer experience insights

When gathering customer experience insights through surveys, it can be tempting to go overboard.

A common mistake most people make is to send surveys too frequently or focus on a range of topics for their questionnaires.

But remember: volume doesn’t always translate to accuracy.

More importantly, always use different survey types in tandem with each other to get a complete picture of your customer’s needs and preferences. For instance, CSAT and NPS forms go hand in hand. GCR and CES studies work the same way.

Finally, always set clearly defined objectives. Know what you want from your audience, understand your metrics and, only then, execute.